Table of Content

In addition, interest payments are deducted from taxes in the Netherlands, and the Dutch tax authorities give refunds of tariffs annually or monthly. The average 30-year fixed-refinance rate is 6.51 percent, down 2 basis points from a week ago. A month ago, the average rate on a 30-year fixed refinance was higher, at 6.86 percent. After a month of declines, mortgage application volume is rising, as current homeowners and potential buyers move on lower mortgage rates. Move your HELOC to UW Credit Union and get six months at a lower rate! Plus, no or low closing costs, annual fees, or prepayment penalties.

Lower can be a good option if you prefer an entirely online application and closing experience. It may also make sense if you have plans to take out a refinance loan in the future but don’t want to pay any fees. So named for its “lower” rates, Lower is a fintech company that analyzes thousands of closed loans and other data points to recommend the best loans for individual borrowers.

Credit Unions

Our site provides links to third party sites and resources not controlled or operated by A+FCU. Other websites may have privacy policies, security, and terms of use that aren’t the same as A+FCU’s. A+FCU isn’t responsible for third party content, agreements, or transactions on linked sites. If you’d rather not continue on to this site you can always call us or stop by a branch to find out more.

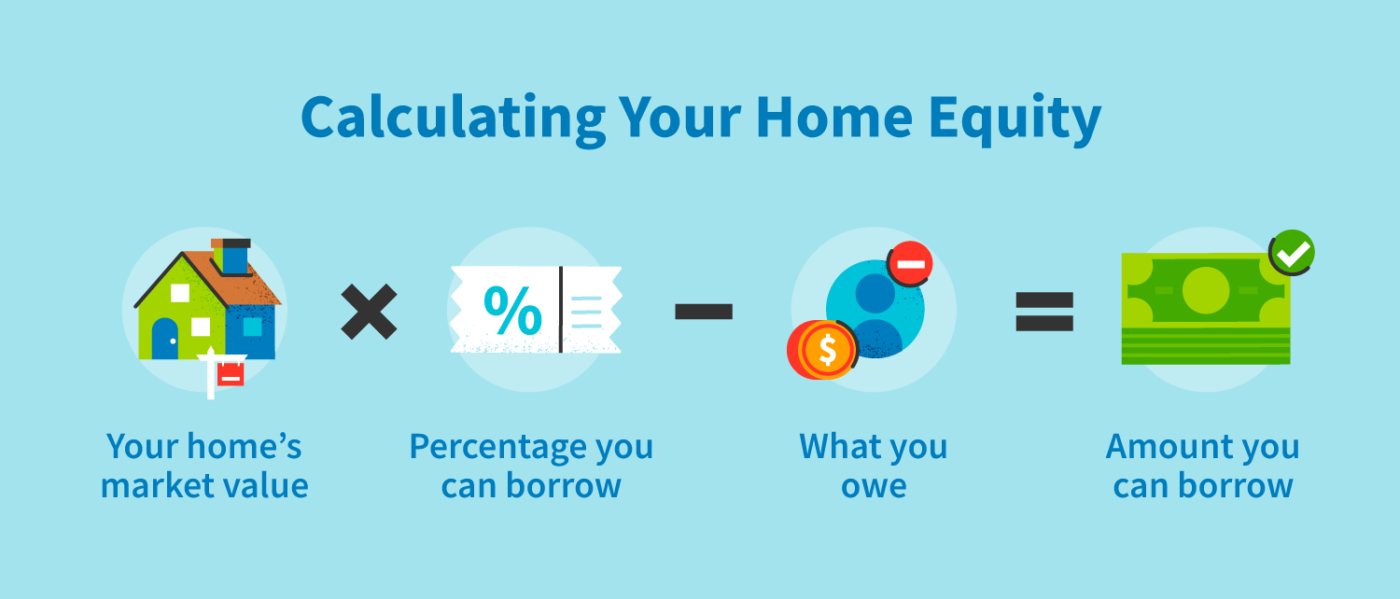

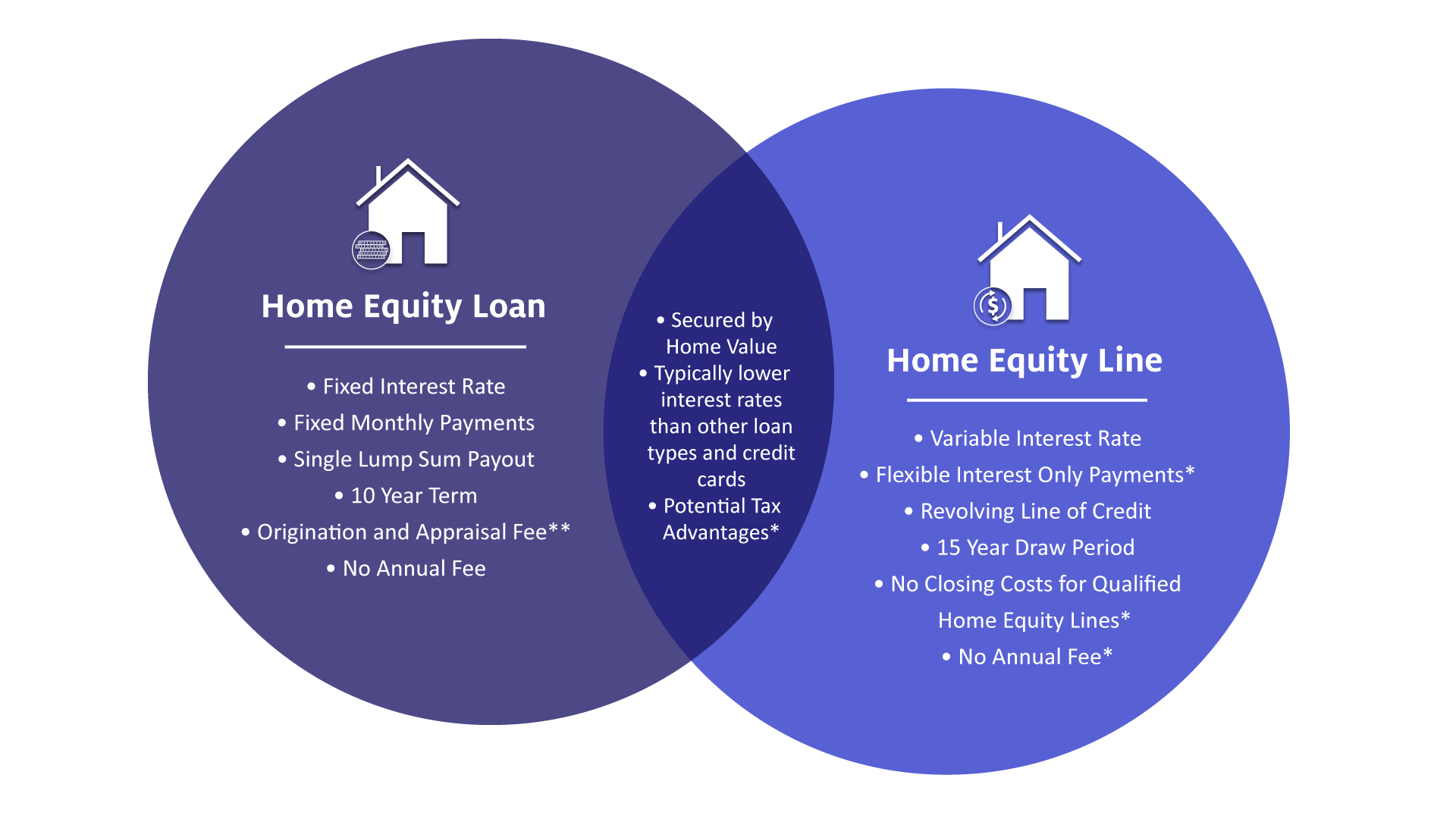

There are a few options available if you’re looking to use your home’s equity. These include a Home Equity Loan, a Home Equity Line of Credit, and a Cash-Out Refinance. Home equity is a valuable asset that can be used to reach a variety of financial goals. A+FCU helps to make sure you understand the ins and outs of home equity loans and compare your options. Home equity loans use your home as security, so their rates are often lower than other forms of borrowing. Ryan Eichler holds a B.S.B.A with a concentration in Finance from Boston University.

Quick & easy online application

Old National home equity loans are available in seven states currently. Count on us to provide the knowledge and tools you need to make sense of your money, better your financial journey, and improve your peace of mind. To keep you from having to do all the math, we’ve provided rates & calculators for all kinds of situations. With a Home Equity Loan, you’ll receive your total loan amount upfront without impacting your first mortgage. Investopedia requires writers to use primary sources to support their work.

They had good technology in place for review and signing of documents. The coordination to make sure I was kept informed was very good. I would definitely recommend them and have recommended my agent to others who would be interested in refinancing.

Pros of home equity loans

So, for example, if you take out a new 30-year mortgage, you’ll have another 30 years of payments ahead of you. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) did increase ever so slightly last week to 6.42% from 6.41%. Lock in steady, predictable payments by converting your HELOC balance into a 5-, 10-, or 15-year fixed-rate home equity loan. Prosper has smart, simple tools for borrowing, saving, and earning with products like personal loans, a credit card, and investing. A home equity loan is a loan that typically has a fixed interest rate and is disbursed in a lump sum at the beginning of the loan. Check your fixed interest rate and credit limit in minutes, with no impact on your credit score.

And as with local banks, if you already do business with a particular credit union, it could be a good place to start your home equity loan shopping. Credit unions, small local banks, large national banks, and online lenders all offer home equity loans. I shopped around with four other lenders in regards to refinancing our home, and Lower was exceptional.

Cons of home equity loans

A home equity loan, which lets you borrow money against the equity you've built in your home, provides you with a lump sum of cash at a fixed interest rate. Mortgages can have lower interest rates than home equity loans, but that doesn’t mean they’re always a better choice. When deciding which loan type is best for you, consider your goals, credit, and current loan terms. Keep in mind that the rates for home equity loans and mortgages are always changing, so it’s important to shop around with multiple lenders to find the latest rates.

In some states, you'll have to do this in person at a physical branch. That's a significant benefit for anyone looking for financing at a time when it's uncertain how much higher rates will rise. If you choose to apply online, you’ll share some basic information about yourself and your home and whether you have a co-signer. However, if you want to continue with the application online, you have that option.

If you can’t get better terms or a lower interest rate than what you have on your existing debt, keep looking at what other lenders offer. Having a plan for how you’ll attack high-interest debt — and how you’ll repay your home equity loan — can set your finances up for a more secure future. Generally, you’ll need a credit score of at least 620 to qualify for a home equity loan, but some lenders offer this type of loan even if you have a lower score or bad credit. This assumes, however, that you have adequate equity in your home and a lower debt-to-income ratio, preferably under 43 percent. If you’re seeking a home equity loan to consolidate debt, the latter might not add up for you. One option is to work with the lender that originated your first mortgage as you already have a relationship and history of on-time payments.

It will also help you calculate how much interest you'll pay over the life of the loan. While a home equity loan can consolidate your debt, it’s only helpful if you limit the spending that caused that debt to pile up in the first place. For instance, if you have a mountain of credit card debt, pay it off and then continue to rack up more credit card debt, you’re making your debt worse. Now you’ll owe a home equity loan payment as well as credit card payments.

Lenders will determine how much you may borrow by considering the amount of equity in your home, your credit score, and your debt to income ratio. A HELoan is disbursed in one lump sum, and you’ll make fixed monthly payments for the duration of your loan. Provided by a mortgage lender, home equity financing allows you to borrow money against the equity in your home. There are no restrictions on how you use this cash, and you’ll typically have an interest rate that’s lower than what you’d get with other personal loans and credit cards that have a minimum monthly payment.

That can mean higher interest rates paid on deposit accounts and lower ones charged on loans. Home equity loans are available from many banks, credit unions, and online lenders. If your credit score is less than 500, work on improving it before applying for a mortgage, because most lenders won’t issue a loan to someone with a score of 499 or lower. On the other hand, if your credit score is higher than these minimums, you may be able to secure a better interest rate. Shopping around is crucial to get the best deal on your mortgage. Make sure to get quotes from at least three lenders, and pay attention not just to the interest rate but also to the fees they charge and other terms.

No comments:

Post a Comment